Ampleforth is a cryptocurrency project that attempts to rewrite how currency is stored and used. You may be wondering what is so special about this crypto project and why the market cap has been increasing.

- Ampleforth is a very unique cryptocurrency and by being different it attracts attention, which raises it’s value.

- The token does allow for some BIG returns with liquidity mining.

Keep reading and I’ll share what makes this project so special. I’ll also share why there was a bubble, the cons to the project, and 2 ways to earn money from it.

What is AMPL?

The token is both elastic and non-dilutive and this means that your supply of Ampleforth may change daily, but the percentage of TOTAL coins will be the same.

If you own 1% of all the Ample coins you will also have 1% even if your supply goes up or down. The reason Ampleforth changes the supply is to solve 2 problems.

1 of those problems is the crazy rollercoaster ride you get on when investing in crypto (big price changes).

The second problem it attempts to solve is the inflation and deflation problems of currency!

The goal of Ampleforth is to be the largest reserve currency for Defi protocols that is more stable.

How Ampleforth works is if the price rises above or below the target price by 5% then this triggers the supply to change.

When the price rises the wallet balance of the AMPL token increases and this reduces the price, but you get more tokens. If the price drops then the wallet balance will also be reduced.

When the coin first came out the target price was $1 dollar, but now due to inflation, the price is $1.05. The target price may change in the future and you can go to this link HERE to learn more.

Inflation is when there is more money in the system, so your money loses value.

If you are curious about where it gets the price information to make the adjustment it uses Chainlink. Chainlink is a crypto project that only provides information to smart contracts and you can actually become an oracle and get paid.

I wrote all about the Chainlink project and how to earn money with it in this post that you can view by clicking on the link HERE.

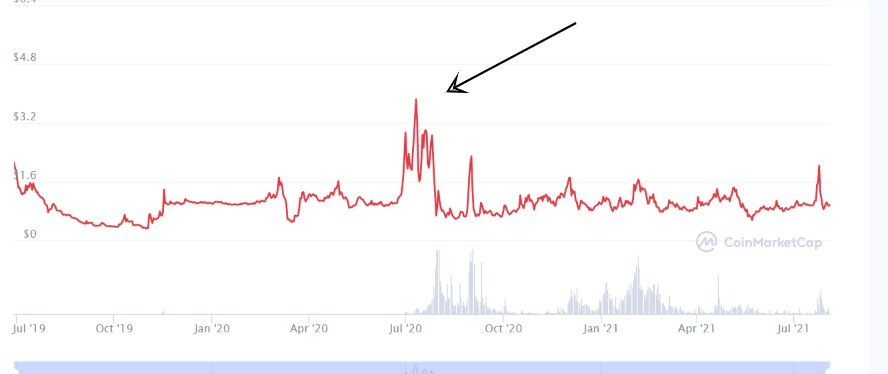

You may be wondering if the price can’t rise above or below 5%, then why were these large price changes in July 2020?

The Bubble

Right before the bubble in July 2020 the team behind Ample introduced the Ample Geyser. The Ample Geyser was created with Uniswap, which is a big decentralized exchange for Defi on Ethereum.

The Geyser’s main goal is to provide liquidity for the exchange and in return, you get rewarded with MORE coins. To make it simple, you could say you become the bank!

When this happened, the project got TONS of attention and everyone rushed to buy the token, resulting in the price jumping.

Then the algorithm kicked in and stabilized the price. You could say that it’s almost like a stable coin, but it’s not backed by any currency.

You could say the AMPL coin is trying to be more stable than a stable coin!

If Ample is a governance token you may be wondering what that means? A governance token allows someone to vote on changes to the blockchain.

How do You Earn Money from Ampleforth?

The million-dollar question is why would you invest in Ampleforth if the price doesn’t go up. There are 2 ways to earn money from Ample.

The first way is to buy some and do nothing. Ampleforth is an interesting idea that has gotten some attention because it’s different. The price may not rise too high, but your supply will increase, and thus you could earn money.

The second way to earn money with this token is from Geyser pools. Ampleforth is a DEFI project on the Ethereum blockchain.

DEFI means decentralized finance. A Geyser pool rewards someone for depositing the token AMPL and providing liquidity for the pool on Uniswap.

The 2 pair of coins that you need to provide is Ethereum and AMPL. You also need to supply the exact same number of coins to the pool.

You can learn more about how “the Geyser” and earning money from the pool by clicking on the link HERE.

Problems with Ampleforth?

Every project has dangers or problems and Ample has them as well. It’s good to know as much as you can so you can make the BEST decision on whether you want to buy some tokens or not.

The largest problem with Ample is the same that faces every social media company that tries to compete with Facebook.

Facebook will just copy them! Oh, and Amazon does the same if a seller is successful, Amazon will just copy them and put that person out of business.

It’s the same with Ample, the code is very easy to copy and if it’s successful other crypto projects could just do the same thing.

This is one of the reasons I like Bitcoin and it’s the safest cryptocurrency to invest in (even if the price is crazy).

Another problem with Ample is many of the tokens (around 60%) are held by large investors (whales) or by the team that started the project.

To be fair, many crypto projects face a similar problem. If 1 large investor decides to sell at once then the price drops.

Conclusion

If you wondering where to get the AMPL token you can find it in Kucoin and Bitfinex. If you are a U.S. citizen like me, sadly you can’t create a Bitfinex account.

Kucoin does allow U.S. citizens and I’ve used the exchange many times. You can learn more about Kucoin by clicking on the link HERE.

Overall, I’m impressed with the coin and think it has a great idea. The most important thing about the AMPL coin is that it’s different.

Being different is a very good thing and it’s one of the reasons why the price (the amount you hold) could be going up. Lastly, if you’re interested in ALL the passive income opportunities I’ve discovered with Bitcoin you can check out this post HERE.

I hope this blog post on why is Ampleforth going up was helpful. Bye for now.