Just like someone can purchase a fraction of a Bitcoin called at Satoshi it is possible to purchase a fraction of an NFT. In case you have been living under a rock an NFT is a Non Fungible Token and this means it’s rare shit like art, but it’s on a blockchain.

An NFT can be divided by having it go into a vault and then be issued ERC-20 tokens that are fungible. Fungible means each token is the same and an NFT is non-fungible meaning it’s rare.

Keep reading and I’ll share 3 main benefits of dividing an NFT 3 unusual advantages that an NFT will bring to an entrepreneur, and 3 things I will look for when investing in NFT’s.

Why an NFT has Value?

You might be wondering what makes an NFT so valuable? Economics comes down to supply and demand. The uniqueness and scarcity are one of the reasons that create the price.

It doesn’t matter how rare something is if NOBODY wants it.

There has to be some type of demand for it and this is the tricky part. The reason Beeple’s NFT’s sell for so much money is due to the history.

He has been creating digital art for 13 years and there is a track record of other people buying it. Someone is investing in the artist just as much as the art.

The reason the NFT of the first tweet sold for 2.9 million dollars is due to the history of Twitter. If nobody heard of Twitter then the first tweet wouldn’t be worth anything.

You might be wondering how you can purchase something digital right? You’re buying proof that you own it. Plus, the Metaverse might bring some new ways someone can use NFT’s, you can read more on this from the link HERE.

When it does come to NFT’s you do have to be careful of scams. I wrote a post on Opensea and the leading scams on it from this link HERE.

3 Main Benefits to Dividing an NFT?

The largest advantage to dividing an NFT is the price. Some of these digital art pieces such as Bored Apes can go for over $200,000. This price range is too high for MANY people. Maybe someone wants to own one of these but doesn’t have that kind of money.

If they owned a fraction of it then they can still own the digital art they want for a fraction of the price.

Another advantage to fractional NFT’s is they can bring more exposure to the creator of the art. Maybe a fraction of an art piece gets listed and someone researches who the artist is.

You could think of each fraction of the art piece as a business card right?

The third benefit is that it can help estimate the price of the artwork. If one fraction gets sold then this can be used as a baseline to determine the price of other fractions.

It’s similar to Real Estate with your house being priced similar to others in the neighborhood.

You might be wondering if you wanted to purchase a fraction of an NFT where would you go? The leading marketplace for them is this one HERE.

What is So Good About NFT’s?

Maybe you’re in the camp of thinking NFT’s are stupid. I used to think crypto was the dumbest thing in the world and that was before I REALLY looked into it.

NFTs are probably in the same camp meaning there is “real world” utility to them. They offer real-world ownership of something that is digital.

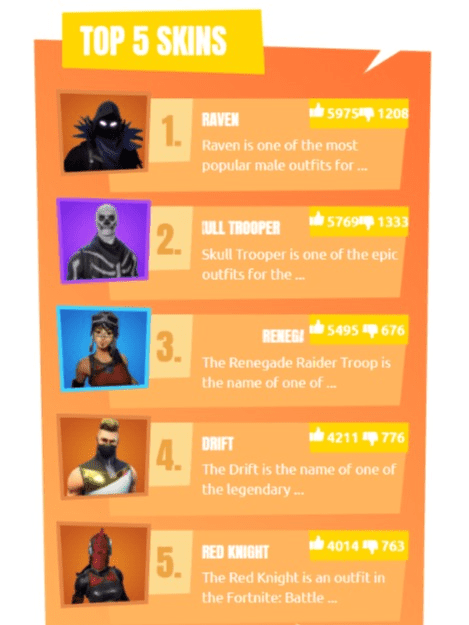

We, humans, are social creatures that communicate things with our clothes, cars, and material wealth. As the world goes more digital this communication is going to expand into the internet with Fortnight (it’s a video game) skins and other indicators of social status online.

NFT’s offer a way to do this.

One utility is collectible art and this is being seen with the Bored Ape Club. There is a smart contract that can represent anything such as…

- Deed to a home.

- Ticket to a rock concert.

- Access to VIP access to an event.

- It could represent something physical like a baseball glove.

- Ownership of a vehicle.

- The list goes on.

Say the NFT is a ticket to a rock concert where something unusual happened like a Janet Jackson Boop showing (it happened in the Superbowl in 2004) then everyone wants to own the NFT of the ticket.

Well, that NFT can be sold, plus there can be royalties to a previous owner or artist where they get paid. The royalty factor is difficult to do with regular art, but with an NFT it can be much easier.

There is a lot of creative stuff that can be done with them for artists.

In a nutshell they offer ownership of something digital and as the world goes more digital due to high gas prices, the green movement, Covid19 and the high cost of traveling, it’s probably going to grow.

Sometimes I wish I lived back in the 1980s when there were hairbands, Garbage Pail Kids (they are cards) and life was simple, but we live in the real world and have to adapt right?

What to Look for When Investing in NFT’s?

NFT’s investing might just be the highest risk investing that I can think of. As everyone says (this is not financial advice), it’s probably best to invest in areas that near-guaranteed chance of making you money.

One idea is to invest in artists that have a proven track record. You see this with the example of Beeple. Since Beeples work has sold for SO much money you have a high chance of selling one for something similar.

Of course, nothing is guaranteed and it’s a risk and this is where the excitement can come in.

It’s similar to domain investing that I wrote about HERE, where you want to get domains where similar ones have sold.

There is NO re-inventing the wheel.

Another idea is to invest in a collection where similar ones are selling for a high price. You can see this with the Board Ape Club and a tool to find these collections is this one HERE.

There are also tools that can help you with research on these fungible tokens. This one HERE can help you determine the floor price of a project. This floor price can help you determine the lowest price the item should go for, but nothing is perfect.

It’s difficult to look at the price history of a project on Opensea and this tool can be helpful.

There is a better tool like Nansen HERE, but it costs $150 a month, which is VERY expensive and probably not worth it unless you’re a hardcore investor.

Lastly, you want to get something that you do like. This is similar to marketing where it’s probably a good idea to market things that you like and appeal to you.

It’s just good for your soul and for karma.

Why would someone purchase something that you think is garbage?

Oh, and if you’re wondering how to find upcoming NFT’s that you can sell for a profit you could check out this tool HERE.

Just go to NFT drops and you see all the new collections coming out.

Conclusion

Fractional NFTs are FNFTs for short offer flexibility to investors and this is a large benefit. However, everything isn’t rainbows and lollipops with them.

An NFT is unique and has 1 owner only and this means it’s NOT a security-like stock. However, if you put one in a vault and start issuing shares, you can see how regulation and security rules MIGHT be alarmed.

This is actually very similar to the crypto project HERE that I wrote about.

Overall, there are more cool stuff that can happen with fractioning these rare crypto tokens. I’m excited to see what the future will hold for them.

I hope this blog post on can an NFT be divided was helpful to you. bye for now.