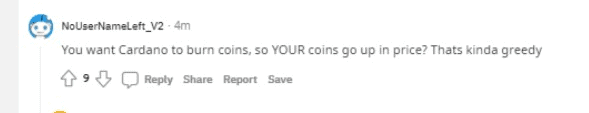

Cardano is currently the 5th most popular cryptocurrency according to CoinMarketCap and you might be wondering does it have a future or will it sink to the bottom of the list.

If you feel more business will be done with smart contracts and there will be more adaption of crypto then Cardano will probably have a future.

The ADA coin which runs on the Cardano blockchain was created by the co-founder of Ethereum called Charles Hoskinson. Not sure what happened, but there was a disagreement and it had something to do with taking venture capital and wanting more governing structure.

The founder Vitalik Buterin didn’t want to take venture capital and wanted to keep Ethereum more of a nonprofit organization. Charles Hoskin wanted a different approach and the two parted ways.

Also, the creator of the crypto project Polkadot Gavin Wood was part of Ethereum with Vitalik and Charles Hoskinson.

What makes Cardano different from Bitcoin and Ethereum?

Bitcoin – is very simple and used as a store of value that can be moved anywhere in the world. It’s simple, secure, and the mother of crypto. Also, there will only be 21 million ever created.

Ethereum – Is more complicated and uses smart contracts. Anything can be created on the blockchain and there is no supply limit. Every year around 18 million Ether is created, but this number could get smaller.

Cardano – Is “very” similar to Ethereum, but has a different approach. Ethereum grew fast, while Cardano grew “slower” with everything being peer-reviewed and looked at carefully. The outcome is “way” more applications are built on Ethereum than Cardano.

Also, there is a supply limit of 45 billion Cardano coins that will ever be created.

You can probably see with the supply limit why Bitcoin is so expensive, Ethereum is the next highest in price and Cardano is the cheapest.

Cardano is being built to “in theory” process 2.5 million transactions per second. This may happen in the future, but the reality is “right now” Cardano can process 7 transactions per second.

Ethereum right now can process 20 transactions per second. The good news is Ethereum 2.0 may come out in 2022 and “in theory” will be able to process 100,000 transactions per second.

To make things simple…

Ethereum is betting on the Rabbit – Cardano is betting on a turtle!

What Happens When all Cardano is Mined?

Cardano works with a proof of stake model. Around 31 billion of the 45 billion total max supply was created (pre-mined) when Cardano first launched.

Proof of stake means if you have Cardano you can stake them to support the network and earn income from your ADA coins. The income is around 5% yearly in interest.

If you are staking Cardano you might be wondering what will happen when all Cardano is mined? How will you get rewarded if there are no more coins that will be minted?

When all the Cardano has been mined people who support the network with staking will get rewarded through transaction fees.

You might be thinking you would get less money. This may not be the case if everything goes as planned. More people will use the network and you could get more money in fees.

“The problem is nothing ever goes exactly as planned.”

This is what makes the world of crypto exciting. The funny thing is “many” inventions are used differently than how they were originally designed.

Coco-Cola was originally created to counter morphine addiction. Another example was Rogaine that was created to reduce blood pressure.

The side effect was hair gain, and since the hair gain was in demand that was what the marketers focused on.

You’re probably wondering when will all the 45 billion ADA tokens be in circulation. Once Shelley is launched then it will be easier to calculate when that would happen. For right now I don’t think anyone knows.

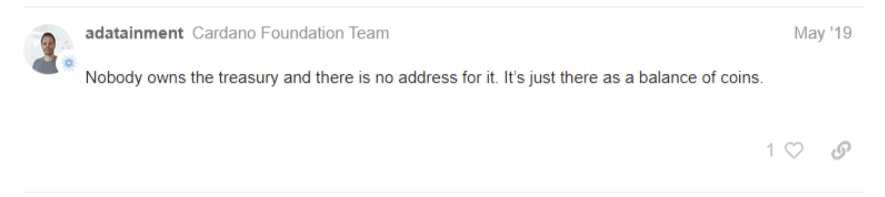

Another question you might have is who has the coins that will be released into circulation?

It looks like the creators of Cardano already created ALL the coins, but have them in a “secret” location to be released.

Will Cardano Burn Coins?

There are No plans for Cardano to burn any coins into the future, but this could change.

Burning coins is a great way to increase the price of a crypto asset. Think of burning coins as decreasing the supply to increase the price.

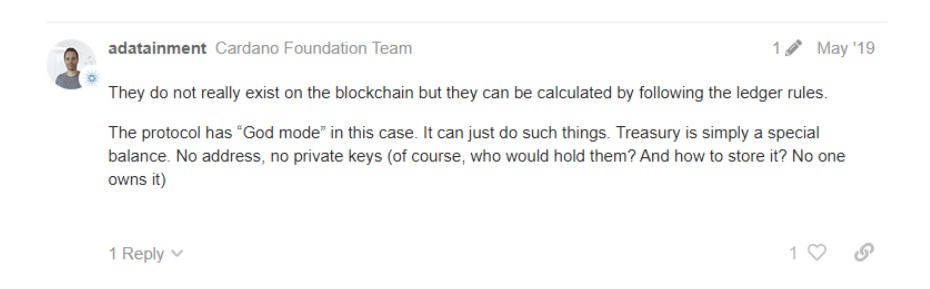

Some Cardano supports feel burning coins is a scam or greedy.

Yes, I am kinda greedy (at least I’m honest) and I want the price of the coins I own to go up. I would be surprised if I found someone that doesn’t want the price of their cryptocurrency to go up.

Burning coins is a “great” way to increase the price and it’s deflationary!

The opposite of burning coins is inflation. If a government prints too much of its money, then this can increase inflation and lead to less buying power.

There is less buying power because there is more money and each dollar is worth less. One of the reasons I got into cryptocurrency is because it’s a hedge against inflation.

You could say taxes are a way to burn coins and reduce inflation.

The good news is Cardano does a limit to the amount of ADA coins that will be in circulation. This alone is a great idea because of supply and demand.

If there is a limited supply and high demand then the price will go up.

How about you, do you prefer coin burns? If so, the Binance coin does a coin burn every 3 months and it’s one of the reasons the coin is ahead of Cardano.

Another crypto project I like is Defi Chain where the founders burned ALL their coins. I guess they believe in the project more than the money. They also didn’t want to be a target that they could unload all their coins on the market at one time.

Ask yourself if you had TONS of coins would you have burned them to help a project?

Defi Chain has some killer rewards for staking and liquidity mining so I have to mention the project. You can learn more about Defi Chain by clicking on the link HERE.

Can Cardano Become Deflationary?

Cardano has a fixed supply of coins at and due to this it will probably be deflationary. The maximum supply of ADA coins that runs on the Cardano blockchain is 45 billion.

A little bit of inflation maybe 2% is healthy for an economy. The reason it’s good is that if people feel prices will rise slightly then they are more likely to spend the money and this helps the economy.

When inflation gets “too big” this is called hyperinflation and it’s no good. Right after World War 1, Germany was in lots of trouble.

It owed lots of money, so the country tried to print its way out.

This led the currency to have NO value. There was a story about a girl who had a wheel barrel of cash to get groceries and someone stole the wheel barrel and left the cash.

I’m not sure the story is true, but inflation isn’t good.

Due to the coronavirus, many countries are printing money in very high amounts. This scares people and why stocks, real estate, cryptocurrency, wood, and even bullets are increasing in price.

Yea, I’ve heard of someone storing wood and bullets in their garage.

The funniest thing to horde is pennies. Before 1981 pennies were full copper and worth almost 2 pennies. Some people are sitting on TONS of pennies hoping they go out of circulation, so they can cash them in and make money.

It does cost the U.S. government 2 cents to make a 1 cent penny.

Cryptocurrency is one hedge against inflation and why Bitcoin, Etherereum has risen so much and pulled many other coins like Cardano up with them.

The challenge with Cardano is they will create 45 billion ADA coins. This is much better than fiat currency, but Bitcoin will only create 21 million.

You can see why Cardano is priced around $1.28 compared to Bitcoins $32,000 a coin at the time of this blog post.

Is Cardano Staking Worth It?

Staking Cardano is worth it if you believe in the project. You can earn around 5% APY on the money you stake, you can withdraw at any time and the minimum amount you can stake is 10 ADA.

You might be wondering what staking pool you should join. There is an app that helps you find these pools and evaluate them and you can get it by clicking on the link HERE.

Ideally, you want the staking pool to not be saturated. When a pool becomes saturated it offers reduced rewards. This is to encourage the network to become more decentralized.

The way you can stake ADA coins is through a wallet. These 3 wallets allow you to stake ADA coins…

You can also stake your ADA coins on an exchange I know Kraken does it. The rule of thumb is not to have too much crypto on an exchange.

The reason why is because of safety and security.

Oh, and most importantly it will take 15 to 20 days when you first begin staking to receive your first payment.

I think the first payment is the “most” important because your belief will rise a lot.

Why is Cardano so cheap?’

At the time of this blog post, Cardano or the ADA coin is $1.28 cents a coin. This is very inexpensive compared to it being the 5th most popular crypto project according to CoinMarketCap.

You might be wondering why is the coin so cheap?

Cardano or the ADA coin has a low price because there is a maximum supply of 45 billion ADA coins. Cardano is also a new crypto project and hasn’t had the same attention as Bitcoin.

31 billion ADA coins were pre-mined and this increased the supply and reduced the price.

Cardano was launched in 2015 compared to Bitcoin being launched in 2009. Due to Bitcoin being the mother of all cryptocurrencies it sucks up all the attention that any altcoin could get. This attention helps Bitcoin gain in price.

Also, not many people know about Cardano. I know 30 days ago I didn’t know what Cardano was.

We live in the attention economy and having Elon Musk tweet about Bitcoin and Dogecoin really helped those projects.

All Cardano needs is a famous celebrity to tweet about it and the price could rise a lot right?

Is Cardano Decentralized?

Decentralization is a major point of crypto. Instead of 1 person controlling everything, the network is controlled by many people and this helps the network become more secure.

When the Shelley update happens on Cardano there will be thousands of staking pools and this will decentralize the network.

When more people join a staking pool the rewards will be reduced. This will encourage people to join another staking pool to get higher rewards and this will decentralize the network.

At the time of this blog post, Cardano is NOT decentralized but is controlled by 3 nodes. These 3 nodes create the blocks and give out the staking rewards.

Also, doesn’t Cardano sound like a mafia family name?

How Cardano will Change the World

Cardano plans on being the blockchain where everyone will want to do business on it. Possibly elections will be on it, loans, real estate transactions, gaming, a stock market, tracking tourism, tax collection, and more.

To accomplish this goal the founder Charles Hoskinson decided to build the network much more slowly than Ethereum. Nobody knows what will happen in the world of crypto and this makes it exciting.

Just my opinion and I can be wrong (this is not financial advice) is if Bitcoin succeeds Cardano will have a place in the crypto ecosystem along with Ethereum.

There is room for many blockchains.

How big of a role Cardano will play nobody really knows. Ethereum does have a huge advantage by being faster and has more applications developed on it.

You can check out Charles Hoskinson’s vision for Cardano by viewing the video below.

I hope this blog post on does Cardano have a future was helpful to you, bye for now.