On the Anchor Protocol, someone can earn around 20% interest with stablecoins, and you may think it’s too good to be true. Some people also think it’s not sustainable, and there are some hidden dangers to this project.

The interest rate with Anchor Protocol will probably decrease over time! The Yield Reserves have been slowly dropping over time. Also, the Protocol earns money from Ethereum staking, and these rewards will be reduced as more people stake it.

Keep reading, and I’ll share how the protocol works, how the 20% interest is generated, 3 risks with this project, and the exact process of how to earn this interest.

Are you ready?

What Does Anchor Do?

Anchor Protocol does 2 simple things: it allows someone to borrow crypto, and it allows someone to loan crypto.

If someone wants to borrow money on Anchor, they first have to put up collateral in either Ethereum or Luna to borrow UST.

The amount they borrow needs to be 80% of what they use as collateral. If someone puts in $1,000 they can burrow $800 of UST.

You might be wondering why someone would do this. If someone thinks Ethereum is going to go higher, they can lock in the price and get $800 to buy more crypto and get MORE gains.

This is VERY risky because if the price drops too low, they can lose the amount they used for collateral.

Oh, and the second use for this project is that someone can deposit stablecoins that are not volatile but are pegged to a U.S. dollar and earn a nice interest rate.

The interest rate at the time of this post is 19.46%.

How can Anchor Afford to Pay Out 19.46% Interest on Stable Coins?

In order for someone to borrow UST stablecoins, they need collateral in Ethereum or Luna. This collateral is staked, and Anchor earns money with it. The protocol also earns interest from people who want to take out a loan. All of this money is used to pay the 19.46% interest rate.

It’s actually a lot more complicated, but if I go into any more detail, I would put you to sleep.

You might be wondering where the name Anchor comes from. The promised interest rate is known as the “anchor,” and this gets voted on by the community.

Can you guess who gets to vote? Yep, people who hold the ANC coin “the Anchor Protocol” token get to vote on stuff.

The promised anchor rate is usually good for a certain amount of time, and then the community revotes on stuff.

Anchor Protocol Risks?

Nothing is perfect, and this project has some risks that are good to know about. Knowing these risks can help you weigh the advantages against the risks and then you can make the best decision for your situation.

- Liquidation Risk

- Smart Contracts

- UST

The “largest” risk with this project is the fact that it has enough money to pay out the “Anchor” interest rate at 19.46%.

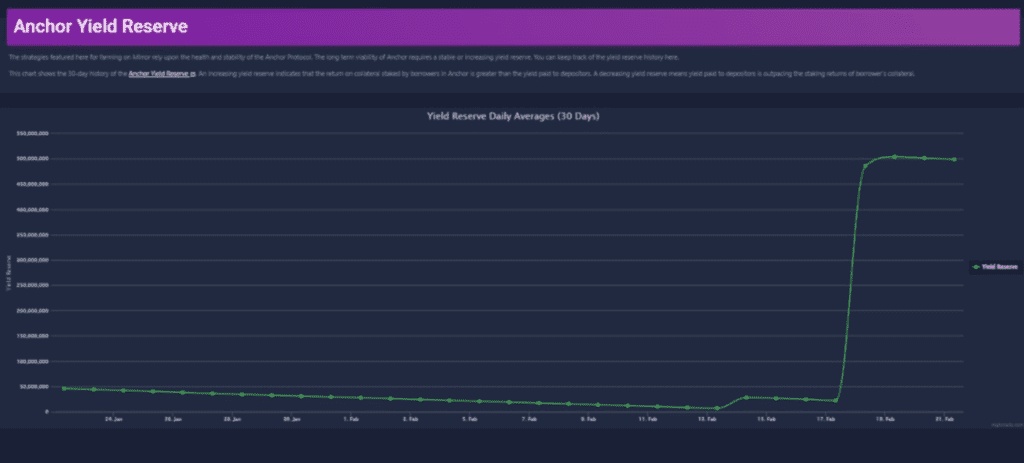

You can see how the yield reserves have been slowly going down until you see a LARGE increase.

This is because members voted on filling the reserve with 450 million UST from the Luna Foundation Guard. You can learn more in the foundation HERE.

You might be wondering where the Luna Foundation Guard comes up with 450 million, right? Some of the money was generated by selling Luna at a profit and buying the stablecoin.

The interest will probably go down due to the yield reserve being reduced and also staking rewards being reduced.

With Ethereum, when more gets staked, the yield gets reduced, and this will impact how much money the Anchor Protocol earns.

The Anchor Protocol is a DEFI (decentralized finance) project, and this means it’s into banking stuff. What is the 1 thing that banks fear?

Yep, a bank run. A bank run is when everyone rushes to get their money out, and the bank doesn’t have enough liquid cash to pay.

Banks earn money by making a deposit and loaning it to someone else, and Anchor Protocol does the same thing.

The good news is that this project has collateral, so if there is a bank run, your money is safe.

The second risk involves a bug in the smart contract. The rule of thumb is that the more complicated something is, the higher the chance of something going wrong.

This reminds me of the first time I tried to windsurf, and man, did I suck (lots of moving parts)!

Bugs happen, and it’s 1 reason why there is Ethereum and Ethereum Classic. You can view the crazy story about the mistaken bug HERE.

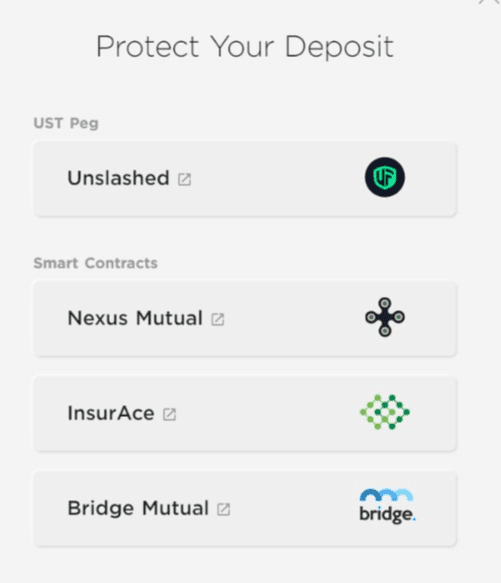

If a bug makes you nervous, you can actually get insurance with the protocol. You can get insurance by clicking the protect your assets tab on the home screen. Then you can get insurance for smart contracts or the stable coin (for a fee, of course).

The third risk is with the stablecoin UST, and there is even insurance for it.

UST is pegged to the dollar, so 1UST is 1 dollar, right? Actually, it’s a little more complicated.

UST is paired to the coin LUNA with a mint and burn system. This means 1 dollar in Luna can be converted to create 1 dollar in UST.

If UST is trading above 1 dollar, then this motivates holders to burn $1 of UST and turn it into Luna, and they could earn some quick money.

This then drives the price of UST back down to $1. So far, UST has been “very” stable, but there is a risk that the value of it drops.

Of course, there are other risks as well, and the elephant in the room is regulation. I think the company Blockfi is going through some issues with that now.

Blockfi is another crypto savings account that you can learn about HERE.

Crazy story, Blockfi went bust over the FTX situation a little while ago. I put a lot of money into it, and luckily, I got it all back, due to courts and crazy stuff.

The moral of the story is crypto is risky!

How to Earn Cash with the Anchor Protocol?

You might be wondering how someone gets started with Anchor, right? The first step is to download the Terra wallet for a smartphone or computer.

You can get the Terra wallet HERE.

Next, you have to get some UST, and you can do that through an exchange such as Kucoin, Bittrex, Bitfinex, and Gate.io

Then you transfer UST to your Terra wallet.

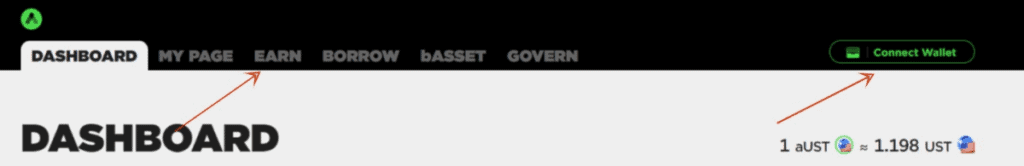

The last step is to connect your wallet and choose the Terra Wallet.

Next, click on the earn tab at the top and choose the amount of UST you want to earn money with.

Important = Some UST has to be in your wallet for fees.

Conclusion

The Anchor Protocol has the highest interest rate I’ve seen with stablecoins. 19.46% interest is VERY good, but believe it or not, you can do better!

When it comes to investing, there are 2 main approaches.

- Income

- Capital gains

You can see these 2 approaches with many types of investments, for example.

- Real estate – You can flip houses or earn income from rentals

- Stocks – Buy and sell or keep and earn a dividend

- Websites – Earn from ads and affiliate offers or flip for money.

It’s the same with cryptocurrency. You could purchase popular cryptos like Bitcoin or Ethereum and just HODL them.

You can also earn passive income with the same coins as your holding. This place HERE is a project I’m a fan of.

I hope this blog post on the Anchor Protocol was helpful to you. Bye for now.