I ran across Cake Defi after viewing a website on free airdrop tokens and wanted to know if it was legit. How can the company pay such high returns? Also, what are the risks involved if I invest in the company?

Yes, Cake Defi is legit. I have invested my money and crypto with them and have gotten good returns.

Keep reading and I’ll share some of the dangers with Cake Defi and with buying cryptocurrency that you should be aware of.

What is Defi?

DEFI stands for decentralized finance. Instead of going to a bank, financial institution, or exchange a person would use smart contracts to make finance happen on a blockchain.

This whole field is very exciting and can provide many benefits to someone. The first thing is why the blockchain?The reason the blockchain can be beneficial is that you don’t have to trust 1 company with your personal data.

Recently insider data theft with Bank of America cost the company millions and data was stolen, you can read more about it from the link HERE.

This was the dream of Bitcoin when it was first created to decentralize personal finance. You really can be in control of your money, not a bank or government.

There is also no central point of attack for the system, this makes it very secure.With Ethereum utilizing smart contracts it makes it possible for more things to be done on the blockchain.

The problem with Ethereum is that it’s Turing complete, while Bitcoin is NOT. Turing complete means that “anything” can be run on it, you can solve any type of problem.

This does sound good, but it’s more complicated, and more things can go wrong with it. Just look at the DOA attack that split Ethereum from the classic version to the version now.

The DOA attack was when a group of attackers “almost” stole 50 million dollars, you can read more about it from the link HERE.

Oh, and there was another hacking attack recently involving 600 million dollars that you can read HERE.

Ethereum also has a concept of loops. You can run a program once and it keeps going and going. This is what happened with the DOA attack that kept taking money from the account.

Yea, oops right?

The language of Bitcoin is none Turing complete, so it’s more secure. Defi Chain is a fork from Bitcoin and it’s based on the Bitcoin blockchain. This means it’s very secure and audited.

Cake Defi is the business that markets and helps people with the Defichain blockchain. Using Cake Defi you can get some really good returns with staking the Defi coin and with liquidity mining or yield farming.

What is Staking?

When it comes to mining cryptocurrency there are 2 ways to do it. You can use your PC to calculate complicated math programs and this is called proof of work or mining.

The problem with this is that it uses lots of electricity. This is one of the reasons Bill Gates has a problem with Bitcoin because of the electricity use and I can understand that.

I’m concerned with the electricity use of Bitcoin as well (I’m a save the planet type of guy).

The second problem with proof of work and mining cryptocurrency is the mining farms. Yea, huge farms have taken control of the Hash power (currency being created) and this is not fair for the little guy.

Then 2 developers in 2011 created “proof of staking.” Instead of using electricity to mine cryptocurrency, someone would use the coins that they purchased or have.

This is what Cake Defi uses and they can pay “very” high returns on their coins. One reason they can pay such “high” returns is they own the coins.

Also if you lock up your Defi coins with them you can get even higher returns. The returns don’t mean anything if you don’t believe in the project.

The point of Defi Chain is to bring decentralized finance to the blockchain. Right now there is only an exchange called the DEX. This is where you can swap 1 coin for another.

Just recently they launched loans and stocks on the blockchain. What is interesting is there is a DEX for stock tokens and this means you can earn some cool rewards!

Crazy right?

The CEO of the project is Julian Hosp. He has a few big Youtube channels that have been around for a long time. The main thing is he comes across as honest to me and that is a big thing I look for.

He also is very knowledgeable about crypto with his Youtube channel on being “crypto fit.” You can check out one of his Youtube channels HERE.

The real exciting part with Cake Defi is Liquidity Mining that I recommend.

What is Liquidity Mining?

liquidity mining is similar to you becoming an exchange. With an exchange, there is an order book where people want to sell an asset and other people want to buy the asset.

This sets the price, based on supply and demand. The exchange charges a fee to match these “love birds.”

Exchanges don’t hold the cryptocurrency, but instead, just match people. In a decentralized exchange or “DEX” the only way for it to work is with a liquidity pool.

Imagine the old pc game called “Sid Meier’s Pirates!” In the game, you could move your ship from 1 port to another buying and selling bananas and guns.

You can make money if you buy bananas low from 1 port and make a profit if you sell them for a higher price at another port.

This is called arbitrage. People do this with “everything” such as stocks, Amazon products, garage sales and you can do this with different cryptocurrencies.

You could do this manually what you would need to start is a pool of money. You could find the prices of 2 coins on different exchanges and make a profit based on the price difference.

A liquidity pool works the same way, but instead of you manually doing it the pool does it for you.

You also get the fees that the pool generates and thus the returns can be “very” LARGE, plus if the price of your coin rises you can make money that way.

Here is a video where Julian the CEO of Cake Defi shares how this works.

Dangers with Cake Defi

There are a few dangers that I do want to mention with Cake Defi. The first one is if you purchase Bitcoin or other cryptocurrencies it seems the price is “very” high.

I would not recommend buying Bitcoin from Cake Defi. A much better option is Coinbase Pro. The price is going to be lower and the fees are very small.

The website Coinbase is “great” and very user-friendly. Plus, you can get FREE cryptocurrency by just watching a few videos. You can check out Coinbase by clicking on the link HERE.

Do NOT buy cryptocurrency on Coinbase!

When you sign up for Coinbase you automatically get Coinbase Pro. The fee to buy cryptocurrency on Coinbase is 1.49% compared to 0.50% on Coinbase Pro.

All you do is go to Coinbase Pro here is a LINK to go there and you’re automatically logged in. Then you upload funds from your bank to Coinbase Pro and then purchase with “Coinbase Pro.”

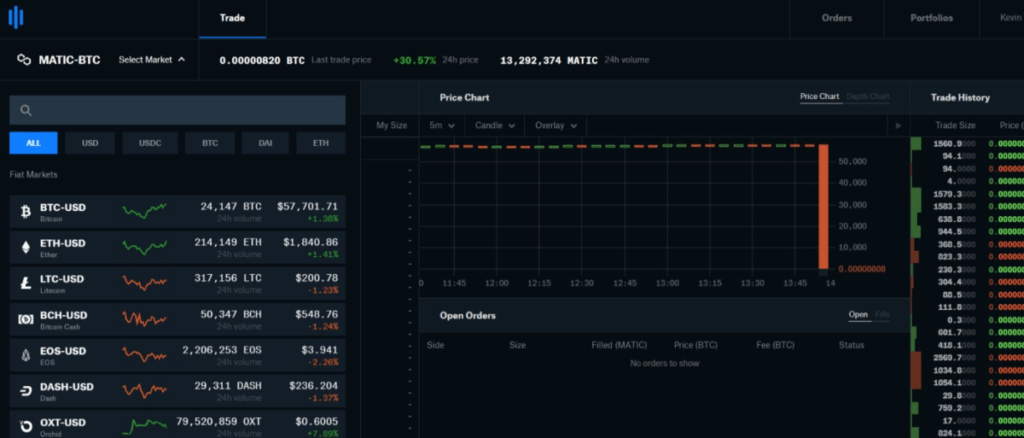

Coinbase Pro looks like…

It does take around 3-7 business days until you move your cryptocurrency. After 3 days you can move it to Cake Defi where you can earn money with staking or liquidity mining.

The second danger with Cake Defi that has to do with liquidity mining is the concept of Impermanent Loss. Impermanent loss is “negligible” especially if you have patience, to me, there isn’t much of a risk.

Impermanent loss is when there is more of 1 coin and the value of that coin has dropped. If you withdraw your funds you would have a loss, but it’s not permanent.

The more patient you are the less risk there is. It really is the same as buying an investment and then the value of it drops and you sell it.

The third risk is if Cake Defi just disappears one day and the money you invested disappears. This could happen, and I recommend only investing what you’re willing to lose.

The truth is this can happen with any investment you make. In the end, you should do your “own” research and go with your gut instincts.

If you break things down on how Defi chain is based on the Bitcoin blockchain it seems very secure. You are also investing in the CEO Julian, which has been in the crypto space for “many” years.

If Julian stole many people’s money that would “really” hurt him. This is a risk that I’m accepting and it’s up to you if you want to accept it as well. Oh, and Defichain also has a HUGE German following, since Julian is from Germany.

It’s THE German crypto project!

Lastly, with Defichain everything is tracked, so I’m not sure how anyone can steal money and get away.

All crypto is just 1 big bank ledger or receipt!

Conclusion

In conclusion, you can always take baby steps. This means following Julian on his Youtube channel and learn about Defi Chain.

You could invest a “tiny” amount of money into Cake Defi. Once you see some returns and your confidence builds you can move to the Defi Chain app.

The app does have a learning curve. You have to wrap your coins before sending them to the app, but once you learn how it operates the returns are even greater.

Cake Defi takes a 15% cut to offer the service on its platform. If you do it yourself on the Defi Blockchain then you can save this 15%.

You can learn more about Cake Defi by clicking on this link HERE. You can also get $30 is FREE coins if you use the code 939517.

Oh, and the Defi token has a maximum amount of tokens that will be created ever is 1.2 billion. Lastly, if you have any questions the easiest way to get in touch is by making a comment on my Youtube channel.

I’ll do my best to help you.

I hope this post on is Cake Defi Legit was helpful to you. Have a nice day.