After looking at the top artificial AI crypto projects Graph could be number 1, but has some similarities to Chainlink. I was curious about what graph crypto does and how it’s different than Chainlink.

I know Chainlink because I tried to become an oracle a while ago (not easy) and I did some digging on Graph and hopefully can simplify things for you.

Graph Crypto is not a competitor to Chainlink because they do entirely different things. Graph organizes data on the Ethereum Blockchain, while Chainlink puts data on the Ethereum Blockchain.

Keep reading and I’ll share 4 big differences between Graph and Chainlink, how the Graph works, if it can reach $100 and I project I’m a big fan of.

How Graph Crypto and Chainlink are Different!

Graph Crypto is a project that indexes data from Ethereum and some have even called it the Google of Crypto.

What this means is that Graph crypto helps someone find something on the Ethereum blockchain. Maybe you wanted to discover who owns the most Beeple NFTs?

Maybe you want to the history of certain Metaworld land prices. Graph crypto could help you find the information and this is where the real-world value is.

Chainlink is different it gives information to someone on a blockchain from the outside world. A great example would be stock prices in the real world.

The other way Chainlink is different is there is NO way to stake LINK tokens (the native token on Chainlink). The ONLY way to earn money is by being an Oracle and providing information to the blockchain.

To keep things simple the LINK token is used for 2 things only!

- Pay oracles to get their data.

- Stake the token so someone can become an oracle.

The Graph Crypto project does have staking with its native GRT token and this means someone can lock up their tokens to support the network and earn rewards.

The GRT token also is used for governance and this means by having the token you can vote on shit.

Another difference is chainlink has a total of 1 billion LINK tokens, while Graph has a total of 10 billion GRT tokens.

I wrote a whole blog post about Chainlink HERE and how you can be an oracle with them and get paid.

| Graph Cypto | Chainlink | |

| What they do? | Organize data on the blockchain. | Brings outside data to the blockchain. |

| Supply? | 10 billion GRT tokens. | 1 billion LINK tokens. |

| Staking? | Can invest tokens to earn rewards. | Can only earn rewards by being an Oracle and fetching data. |

| Governance | Holding tokens allows you to vote. | No governance for holding the token. |

Who is behind GRT?

GRT is a token that was created by…

- Yaniv Tal, an electrical engineer.

- Brandon Ramirez who specialized in studies with Robotics.

- Jannis Pohlmann a computer scientist.

The three founders started creating smart contracts on the Ethereum blockchain, but they realized a problem. Sifting through the data on the blockchain was NOT easy.

The 3 launched the Graph protocol in June 2018. The graph is an ERC-20 token and this basically means it works well with exchanges and wallets.

You could think of an ERC-20 token almost like WordPress for a blog, it just makes it easy to work with. You could build a blog without WordPress, but it’s MORE difficult.

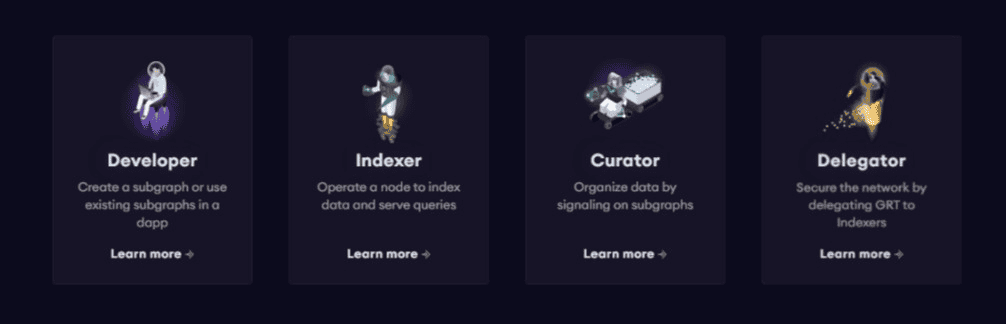

The Graph protocol uses an elaborate system of indexes that find data and get paid with the GRT token, delegators that act like the police to ensure indexes are doing their job, and curators that act like the IRS doing audit checks on the indexers.

You can learn more about this system by clicking the link HERE.

At the time of this blog post, the Graph only runs on the Ethereum blockchain, but eventually, the founders would like to move to other blockchains.

Does GRT Have a Max Supply?

The GRT token does have a max supply of 10 billion tokens.

The good news is that 8,783,000,000 have already been released and are circulating. This means that most of the tokens that are going to get printed have already been printed. The bad news is over a billion tokens STILL have not been created.

1% of all query fees go to burning the token to reduce the amount. Burning of tokens means they are destroyed, which raises the price of them – since there are fewer of them.

The withdrawal tax for curators is also burned. GRT can be deflationary (meaning the amount keeps getting reduced) if “enough” people use the project to search for things on the Ethereum blockchain.

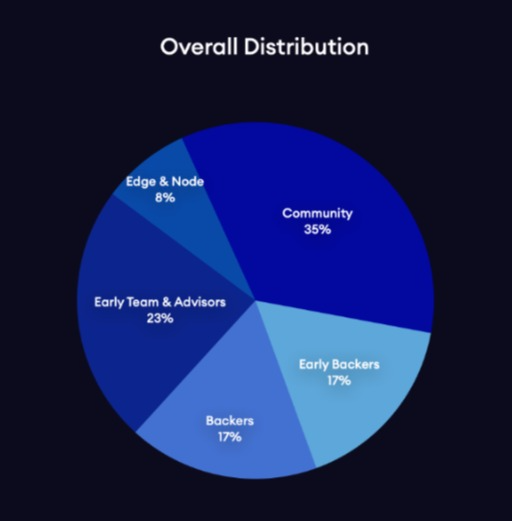

According to a crypto expert over at CryptoBanter, more than half of GRT tokens were given out to early investors. This isn’t good because the crypto is more susceptible to dumping where if someone sells a shit ton of them, then the price could collapse.

The tokens given out during the ICO (initial coin offering) have a locked schedule between 6 months to 10 years meaning they can’t be sold before a certain time.

The GRT token can reach $100, but it’s not easy due to the supply. Still, if the demand is HUGE there is a chance, but it’s very small.

Is GRT a Governance Token?

The GRT Token is a governance token and this means if you hold the token you can vote on proposals.

There are 2 parts to the governance of this token. The first part is the Graph council which is made up of 10 people HERE.

These 10 people vote on technical upgrades and “the MOST important” stuff. The little stuff token holders can vote on.

This “little” stuff would be things such as the inflation rate of the token, how many tokens get burned when someone searches a query on the network, taxes, and other things such as if there should be a cool mascot.

Closing

The FTX collapse did hurt crypto “in the short-term” and the truth is there are a lot of shitcoins, greed, and money-grabbing products in this industry.

Still, there are some solid projects in crypto that can provide benefits to society and that is what I look at. In the LONG-RUN these solid projects will probably survive, while the shitcoins probably will disappear.

Investing in “good” projects you believe in and hold for the long term can be a good strategy and a hedge against the printing of currency (inflation). Still, it’s a good idea to always do your own homework!

There is one project I do “really” like and I wrote a full ebook about it and some unique things about crypto that MOST people don’t know. You can view this free eBook by clicking on the link HERE.

I have a love/hate relationship with crypto, but in ALL honestly, crypto has done very well for me even with the collapse of FTX (it’s difficult to ignore).

Sometimes I wish I could live back in the 1980s, but we all have to adapt to technology and learn about it. Crypto will probably be around for a long time (hate it or not) and I’m very bullish on some projects due to the fewer bills and overhead the owners have to pay meaning they are more competitive.

I hope this post on graph crypto was helpful, bye for now.