I keep hearing about this app Acorn and was wondering if I can build my credit with it. I also wanted to know the pros and cons of using it.

The app Acorn does not build your credit. It can make investing easier and thus earn you money.

In this post, I’ll explain how exactly Acorn works. I’ll share how someone can earn money using the app.

Plus, I’ll share some of the dangers and features of using it. Lastly, I’ll share how someone can improve their credit and other investment ideas.

What Does the app Acorn do?

In a nutshell or (acorn shell) the app helps people invest. The way it helps someone invest is by automatically investing spare change from debit or credit card purchases.

The app has NO impact on your credit score. This app will not help or hurt your credit score.

The app works by rounding up spare change and investing the difference. Have you ever been to a grocery store and were asked to round up your change for charity?

This app does the same thing, but you’re giving yourself the charity money. For example, maybe you spend $29.50 buying groceries, the Acorns app would take 0.50 cents and invest it.

Yes, you do have to pay for this convenience and the fee is $1 per month. If you make TONS of small purchases then this $1 monthly fee is a better bargain.

If you make 20 purchases a month and invest 50 cents per transaction then you would invest $10 a month. The Acorns app would cost you $1 and thus the fee would be 10% for the service.

You’re paying for someone to do the investing for you.

If you make 200 purchases a month and invest 50 cents per transaction then you would invest $100 a month. The app would cost you $1 and thus the fee would be 1%.

The 1% fee is MUCH less than the 10% fee.

Still, the point of investing is to make money, so you want the fees to be as low as possible. This is the largest negative to the app is the fees.

Another danger to this service is you don’t want to make TONS of small purchases just to invest your change.

Buying something you don’t need JUST to invest your change is not going to help you. It would be better to learn how to invest and do it on your own, this way you don’t have to pay the fee.

Still spending $1 a month to invest is better than NOT investing at all. For this, the app is a winner.

What does Acorns Invest In?

Acorn has 5 different packages you can choose from.

- Aggressive – 100% stocks.

- Moderately Aggressive – 80% stocks and 20% bonds.

- Moderate – 60% stocks and 40% bonds.

- Moderately Conservative – 40% stocks and 60% bonds.

- Conservative – 100% bonds.

This is all you can choose.

You can’t choose individual stocks, Bitcoin, or gold. The aggressive portfolio means higher returns and a higher risk of losing money.

Conservative means lower returns and a lower risk of losing money. Notice how the conservative package is 100% bonds?

Bonds is when you loan money as a bank does. Keep in mind when it comes to bonds the interest rate affects how much you earn.

When the interest rate goes up, the market price of the bond gets lower. This means if you have a bond it’s better to sell it if you think interest rates will rise.

Other Ways to Build Credit

The app Acorn will not affect your credit score, but there are some things you can do to improve it. The truth is building your credit takes time and effort.

There is NO improve credit fast system. Some credit repair agencies may say they can raise the score fast, but there is NO secret to doing it.

Here are some strategies that I’m confident WILL work.

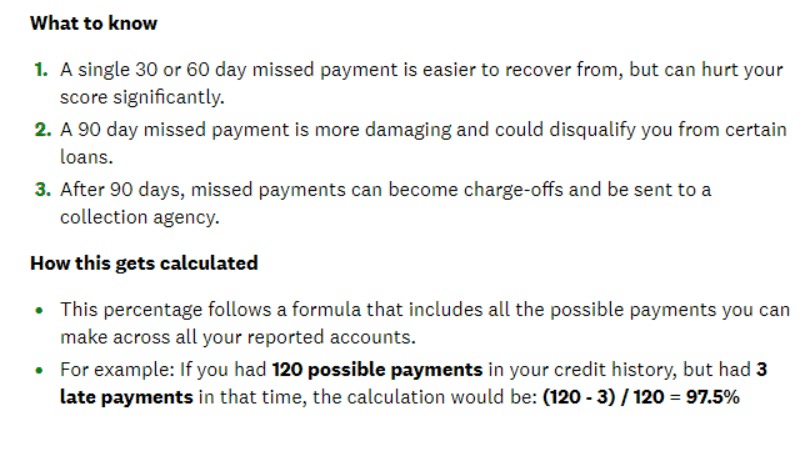

You probably already know that late payments will lower your credit score.

The #1 thing you can do to build credit is NEVER ever making a late payment.

The truth is we are ALL busy and sometimes it’s easy to forget right?

What you do is set your payments to autopay.

Yea, automatically pay your credit cards or any other payments this way you will NEVER have a late payment.

Do this right now, make sure all your payments are on autopayments.

Come back to this post when you’re done doing this.

Another thing to avoid is hitting your credit card limit. Not using your credit card can help you, try to stay under 30%. This means only use your credit card 30% to the max.

ICO shares that consumers with a credit score of 800+ use 5% or less of their available credit card limit on average. You don’t need to carry any credit card debt to build your credit. You do want to use your credit card at times, to keep it active.

Hard inquiries from things such as a credit application can stay on your report for 2 years, but their effects fade with time.

A great idea is to use CreditKarma.com and use their approval odds before you apply to avoid unnecessary hard inquires.

Another way to build credit, which you probably already know is to check if there are any mistakes on your credit.

The first thing to do is to go to Creditkarma.com and create an account. You will be asked for your name, address, and last 4 digits of your Social Security Number.

You have to give them the last 4 digits of your SSN.

When viewing your credit report you just want to make sure everything is accurate. Do you see anything that is NOT right?

It’s YOUR responsibility that your credit score is correct.

If you find any mistakes you should contact the credit bureau where you found the mistake. Here is where you can contact each credit bureau.

Other Features of the App Acorn

Acorn has 2 other plans so the company can make more money. They have a plan called Acorns personal and it’s $3 a month.

This plan includes a debit card and 55,000 free ATMs globally. This includes any ATM that takes a Visa card. If you get a fee for using the ATM then Acorns will reimburse you. There is also a feature where Acorns invests 10% in certain businesses.

This means that if you click on local offers it will bring up a map where some local businesses give you a percentage for shopping with them.

It’s a way to help local businesses and you can save 10%. There are no guarantees that it will work in your area.

Also in this plan, it includes picking an IRA, Roth IRA, or SEP IRA. What an IRA does is invest the money and helps you save money on taxes.

The catch is you can’t touch the money until you’re at the age of 59 and ½. You can withdraw money, but you will pay a 10% penalty if you’re under this age.

Lastly, Acorn has a plan called Family and this includes everything in the first 2 plans, but you can open an investment account for kids.

A kid is anyone under the age of 18. If you are under 18 you can’t open an account, but be tied to your parent’s account with the family plan.

Also, there is no limit to the number of kids you can have on this plan. Just remember that you can’t give a kid more than $15,000 per year without paying more in taxes with the gift tax.

Married couples can give up to $30,000 a year per person before having to pay the gift tax. The gift tax is just a form you fill out and you may pay 18% to 40% in taxes.

Other Options for Investing

The app Acorns isn’t the only option for investing. Another great idea is Charles Schwab that has NO ATM fees and there are no monthly fees for using it.

Also, Charles Schwab doesn’t charge fees for buying and selling stocks.

Another idea that I like is Vanguard. Vanguard is famous for creating the S&P 500 index fund. The fund has an expense ratio of 0.04%. The fees are MUCH lower than $1 a day.

The catch is you need to have at least $3,000 to open an account.

Warren Buffet the legendary investor recommends his family invest in the S&P 500. It’s just the largest 500 companies in the U.S.

You are investing in the U. S. economy and it’s much less risky than individual stocks.

Oh, and who can forget about Bitcoin and crypto? I used to think crypto “was stupid” I’ve changed my mind and have made some good money with it.

You can click on the link HERE, to discover all the top ways I’ve found to earn money with crypto.

I hope this blog post on does Acorn build credit was helpful to you. Have a nice day.