You might have heard of the NEAR Protocol and wondered what the fuss was about. Does the project have potential or is it another shitcoin?

The NEAR token is used to pay for transaction fees, used to pay for collateral for storing data on the blockchain, rewards for stakeholders, and for governance so holders can vote on proposals.

Keep reading and I’ll share what the hell this project is about, what makes it special (AKA different), 5 concerns with this project, and if it’s deflationary.

What the NEAR Protocol Project is About?

The NEAR Protocol is a blockchain that runs smart contracts on it such as Ethereum. There are MANY of these projects out there trying to kill the top dog Ethereum such as Solana that I wrote about HERE and Polkadot HERE, Cardano HERE and SO many others.

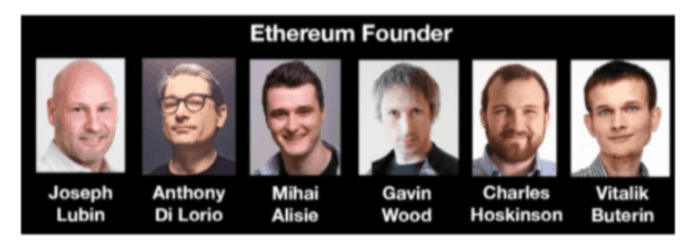

Funny enough many of the top leaders in these projects were friends I guess the saying “Too many chiefs, not enough Indians” rang true here.

Gavin Wood founded Palkadot and Charles Hoskinson started Cardano (which sounds like a mafia family). Of Course, Vitalik Buterin is the founder of Ethereum and is the youngest crypto billionaire at 27 years of age.

The NEAR Protocol does have a few unique cool bells and whistles. One of the unique things about it is something called sharding.

You could think of sharding as eating a pizza with 8 slices. Instead of you eating the pizza by yourself you got 7 of your friends to help. By having your friends each eat a slice you would be done MUCH quicker right?

Sharding works the same way by splitting the work between different validator nodes. A validator node is responsible for verifying and maintaining a record of transactions.

Sharding makes transactions very fast at around 3,000 transactions per second compared to Bitcoin which does around 4.5 transactions a second.

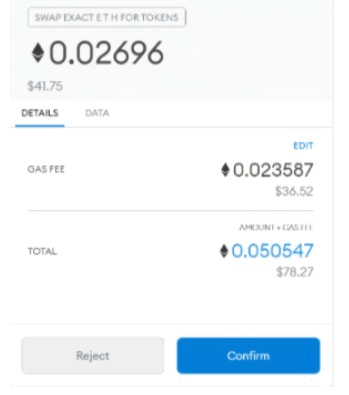

More goods are the gas fees are VERY low at around 1 cent. Ethereum can have VERY high gas fees.

More good news is if you stake NEAR there is only a 2-day hold if you decide to unstake them. Some projects are more strict such as Polkodot which makes you wait 3-4 weeks.

In a nutshell NEAR Protocol does have a solid foundation!

NEAR also works well with others, which is important. It’s like the guy at a job who has a good attitude and gets along with everyone he has value – compared to the guy that is constantly complaining right?

NEAR works with other blockchains with Aurora allowing developers to bring over their Daaps on Ethereum and run them on Near Protocol with fewer fees.

Aurora is an EVM (Ethereum Virtual Machine) and it’s the same code that runs Ethereum and its smart contracts.

Another way that NEAR plays well with others is the rainbow bridge (nice name right?) this just lets someone move their money from different blockchains onto NEAR.

The last cool thing I can think of (I’m sure there is more) is it works well with developers. 30% of the gas fees (too bad they are low) go to the developers.

They also support many Coding languages that developers can use.

Does NEAR Protocol Have a Future? 5 Concerns!

The NEAR token does have a lot of good stuff going for it, but there are some concerns.

One concern is there are not a lot of users using NEAR. Seriously, the name NEAR PROTOCOL just sounds boring right? The marketing department is sleeping too much and the word isn’t out on this project.

Also, the token isn’t available in many exchanges and this hurts the project. For U.S. holders the only place is Crypto.com or I’ve found it on Binance.US.

The third concern right now is the NEAR Protocol is centralized (controlled by a few people) with 4 board members. In the future, the plan is to have DAO’s and Guilds run the show.

DAO’s are Decentralized Autonomous organizations where the more tokens you have the more voting power you have to decide the direction of the project.

They only have 100 validators and it’s very difficult to become a validator. As of right now, only validators can vote on stuff.

The largest concern is it faces some LARGE competition from other smart contract projects. There really are SO many and Ethereum has a HUGE advantage being first with name recognition.

I also believe “speed” is very important when it comes to business.

Oh, and the fifth concern is the tokenomics isn’t the best and this could hurt the price of the token.

Is NEAR Protocol Deflationary?

The NEAR Protocol isn’t deflationary due to the 5% inflation per year. The project does burn transaction fees and if a smart contract is involved 30% of the fees go to the creator.

Deflationary means the supply drops so each coin is worth more. This is the opposite of inflation when a country prints TONS of money and your money gets worth even less.

For example, Bitcoin supply is dropping and this means it’s deflationary. Low supply and high demand mean a price increase. Of course, there still HAS to be demand right?

Some people are fascinated with the technology of the blockchain, but they ALL have some type of coin attached to it and this helps with funding, getting attention, and to motivate people to use it.

The NEAR protocol has the NEAR coin (could have guessed this right?) and there is a maximum supply of 1 billion NEAR tokens and around 600 million currently in circulation.

The coin is used to…

- Pay for transaction fees.

- Governance (vote on stuff).

- On-chain data storage

- Rewarding validators and stakers.

- Helps pay developers to develop on the blockchain.

Many early investors have them locked. This means they can only sell their coins after a certain amount of time. This means to be careful of these dates because early investors might want to sell their coins and this could drive the price down.

The good news is staking (where coins are locked) I wrote how staking works HERE, and fee burn can help but the supply is still increasing as you can see from the chart below.

Conclusion

The NEAR Protocol has a solid foundation but has poor marketing and the tokenomics isn’t good for investment reasons.

If you’re interested in earning good money with your crypto I would recommend checking this out HERE. Also, the easiest way to earn money might just be to take some of the bills you’re already spending money on and figure out ways to lower them.

This right HERE has some fascinating ways to cut your home bills and there are some you probably don’t know about. Knowledge can be power right?

I hope this blog post might have been a little helpful, bye for now.