The company Ripple created the XRP token and it does some interesting things. You might be wondering why the price has been dropping.

The XRP token that the company Ripple created has dropped due to the volatility of Bitcoin, the SEC lawsuit, and supply and demand.

Keep reading and I’ll share what makes XRP different than all the other cryptocurrencies. I’ll share what the SEC lawsuit is all about and what is the difference between XRP and Ripple.

Ripple or XRP?

Ripple is a private company that created the XRP token that is a cryptocurrency and they are NOT the same thing. the token XRP could crash and go to 0 and It would not affect the company, Ripple.

The crypto XRP is very unique. Most crypto is all about decentralization and power to the people NOT banks. XRP is centralized and gives power to the banks.

XRP is all about helping people transfer funds around the world. Right now if you want to send a wire transfer to another country it would take several days and would cost a lot of money in fees. Then there is currency conversion that can add more of a cost.

The reason bank wire transfers cost a lot and take many days is because the system is outdated and old. Bigger banks sometimes have to go through smaller banks to reach the bank the wire transfer is trying to get to.

XRP tries to simplify and streamline this system.

XRP was started in 2004 by Ryan Fugger a software developer in Vancouver, Canada. Did you notice that 2004 is before Satoshi released the white paper for Bitcoin in 2008?

In 2012 Fugger sold the idea to Jeb McCaleb and 2 other guys and it was named Opencoin. In 2013 Jeb McCaleb left the company and started Stellar, forking Ripple to create the new network.

Jed McCaleb sold around 1 billion XRP and still had over 8 billion.

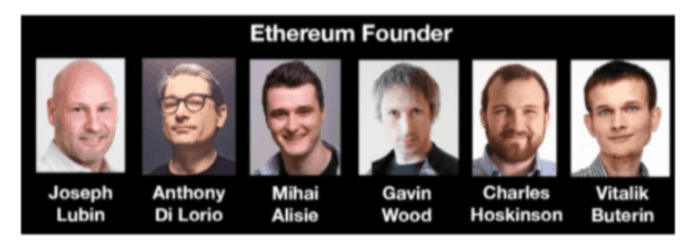

It’s interesting how in the crypto world it seems like everyone takes ideas and creates their own blockchains. Just look at how 2 of the founders of Ethereum created their own blockchains.

Charles Hoskinson created Cardano and Gavin Wood created Polkadot.

I guess everyone wants to be the chief and nobody wants to be the Indian!

As time went on the company Ripple developed its blockchain to improve money transfers. They designed xRapid, which requires the cryptocurrency XRP to settle transactions.

What some people don’t know is that the company Ripple that created the XRP cryptocurrency has 3 products and only 1 uses the XRP token.

The flagship product of Ripple is Xcurrent. Xcurrent provides a service to allow banks to transact with each other.

XRP is also meant to be “very” cheap and “very” fast. Here is how XRP compares to Bitcoin and Ethereum.

| XRP | Bitcoin | Ethereum | |

| Transaction Time | 3-5 seconds | 2 Hours 48 minutes | 15 seconds maybe more |

| Transaction Cost | Less than 1 cent | Around $10 dollars | $4.42 |

What Determines the Price of XRP?

There are 3 things that are determining the price of Ripple. The first one I’m going to talk about is the elephant in the room.

Do you know what the elephant in the room is?

Yes, it’s Bitcoin. Bitcoin is the mother of cryptocurrency and it usually gets traded on emotion. Maybe something is in the news about China, Elon Musk, El Salvador adopting it, or whatever.

When Bitcoin goes up it can pull many other altcoins up with it such as XRP. If Bitcoin drops because there is a negative news story about it then the price of altcoins such as XRP can drop as well.

I’m very skeptical that Bitcoin would drop and altcoins would rise above Bitcoin. Bitcoin is similar to a .com domain name that probably will be worth more than some other extension such as a .net or .xyz domain name.

Bitcoin is probably the safest bet in the world of crypto. There are also some interesting ways to make passive income that I discovered and if you want to learn this click on the link HERE.

The second huge factor that influences the price of XRP is supply and demand. There will only ever be 100 billion XRP coins in existence and this is the supply.

Actually, there are 45 billion XRP in circulation and 55 billion XRP Ripple Labs owns in a secret account. Ripple plans to release 1 billion coins every month.

- When more people want to buy XRP than people wanting to sale it then the price goes up.

- When more people want to sale XRP than people wanting to buy it then the price goes down.

You can see the price going up and down to match supply and demand on Coinbase Pro. You see the lines going down this is the seller reducing the price to match the price a buyer is willing to make.

If there is NO buyer then the price keeps going down until a buyer is found.

The chart above is for Bitcoin because Coinbase removed XRP due to the SEC, which I’m going to talk about right now.

XRP and the SEC

In the past, the U.S. security and exchange “SEC for short” had ruled that Bitcoin and Ethereum were cryptocurrencies. There is 1 main difference between XRP and the rest of the cryptocurrencies.

Bitcoin and Ethereum use a public ledger and both of these currencies create coins through mining or proof of work.

XRP uses a private ledger that isn’t public. Also, there is NO mining, all 100 billion coins were already created when XRP was launched, but they are not in circulation.

Now there are around 48 billion in an escrow account and they will release around 1 billion a month into supply. Ripple also owns 6.4 billion XRP.

When you compared XRP to Bitcoin you could make the case that XRP isn’t a currency, but more of a security. A security is something like stocks, bonds, EFTS, or options.

In December 2020 Ripple Labs was charged with offering unregistered securities. The SEC claims Ripple Labs raised capital through issuing securities through XRP.

The SEC also claimed that Ripple Labs failed to provide investors with information on what the XRP token was funding.

As you can see “shit hit the fan.” Regardless of who wins the lawsuit the damage was already done and this scared investors.

The price of XRP dropped as more people rushed to sell their XRP tokens and fewer people wanted to buy them. Another problem for XRP is that many exchanges delisted the project.

In fact, “every” major exchange delisted the project. It’s easier if I list the places where you could purchase XRP if you wanted to now.

Here are the 3 exchanges where you can buy the token.

- Bitstamp

- Kraken

- Gatehub

Every other exchange has delisted the XRP token.

Conclusion

In the end, only a court will have to decide if Ripple Labs was selling cryptocurrency or a security to finance their business.

If you do invest in XRP it’s a “very” risky bet. The problem with investing in XRP is “you don’t know what is happening.”

What could happen and this is “just my opinion” a guess, is there will be a settlement. Most things settle outside of court and the SEC and Ripple probably don’t want to go to court.

It’s all about the money.

The safest bet in the world of crypto is Bitcoin. Ethereum is the second safest bet, but Ethereum is going through lots of changes you can learn about these changes from a post I made HERE.

I hope this blog post on why does Ripple keeps going down, was helpful to you. Bye for now.