The Yearn Finance token is tens of thousands of dollars and maybe you’re wondering why it’s worth so much. Also, is the project worth investing in?

The Yearn Finance Token has a high price because there are only 36,666 tokens. You can also use the token for staking and to vote on upcoming ideas.

Keep reading and I’ll share what Yearn Finance does, why the token is worth so much if the token is undervalued, why the iron bank is unique and the project I’m “most” bullish on.

Why the Token is Worth So Much?

YFI is the native token on this blockchain and some people call it Y-Foo. The token has 0 pre-mine (it’s where they give a lot before launch). The reason this is good is because it makes it fair for everyone.

This 0 pre-mine is as rare as a “baby hippo in a tutu” (I got this saying from an old sales gig I did). The token was initially given as a reward for people who used the platform.

ONLY 36,666 YFI tokens were created and they have all been given out already.

There are 2 uses for this token.

- Staking

- Vote on stuff

If you’re not sure what staking is you can check out this post I made on how it works. In a nutshell, you earn money from your money. (cool right?)

Also, the YFI token runs on the Ethereum blockchain and is an ERC20 token. You can think of an ERC20 token like WordPress for a website (it just makes it easy to build on).

It also just makes it easier for wallets and exchanges to accept the token (to keep things simple). ERC means Ethereum Request for Comment and 20 is just a random number.

In case you’re a nerd (like me) 50% of all the tokens on the Ethereum blockchain are ERC20 tokens according to this source.

What is Yearn Finance?

Yearn Finance is a DeFi (decentralized finance) project that is built on Ethereum. It was created by Andre Cronje who some people feel created DEFI.

He built an automated system for yield farming for himself.

Later he thought others could use this system and I-earn was born and later changed its name to Yearn.Finance. In case you’re wondering what Yearn means it’s a longing for something typically what was lost or separated from.

The fact is EVERY DeFi project is built on Ethereum apart from 1 that I know of.

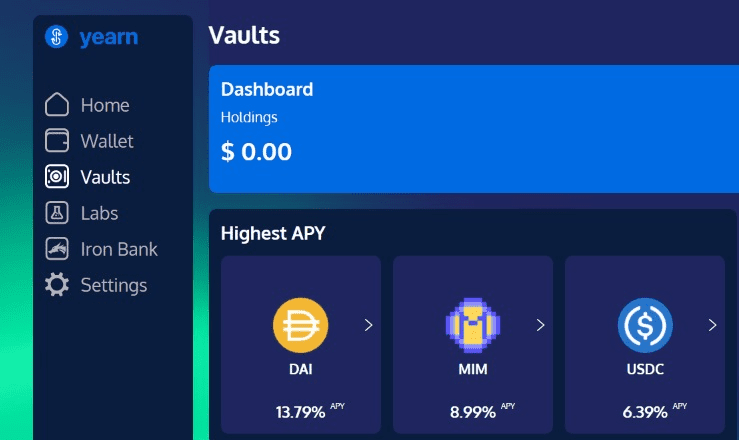

Yearn Finance is a dapp (decentralized application) that supplies money to various pools on Ethereum.

These pools can be Aave that I wrote a post about HERE, Compound, and DYDX. These pools have rewards that fluctuate and the Yearn dapp tries to find the highest rewards for your money.

You could think of it like a little employee that works for you.

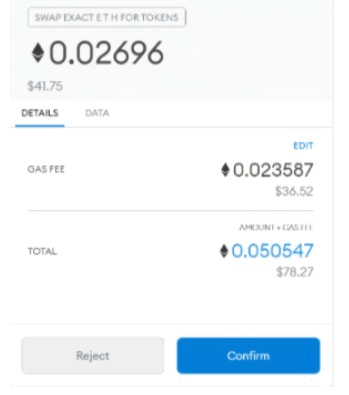

When it comes to Ethereum what does everyone hate the most? Yes, gas prices.

The reason you would want to use yearn is because it can save money on the (dreaded) gas fees. You could think of instead of getting into your car and driving 100 miles you would carpool with 4 people and all split the gas.

Another service Year Finance offers s you can loan tokens and earn interest and this is the “iron bank”. Reminds me of the series Game of Thrones right?

What is “very” interesting is they are offering zero collateral loans through a partnership with “Cream”. How they are doing this is a credit system. It does seem they are very strict on who gets a loan.

You can read the full article on how this works HERE. How do you feel about this?

Seems very risky. I would be too nervous burrowing money and lending money. Another project HERE does lending with crypto, but they ask for collateral, so it’s almost impossible to lose money.

Honestly, I’m NOT a fan of leveraged investing in crypto. Part of the reason for the depression in the U.S. was “many’ people buying stocks on margin (borrowing money). Crypto is risky enough as it is, add burrowed money and I’m not sure if that is brave or stupid.

Brave if you earn money and stupid if you lose money right?

Is Yearn Finance Undervalued?

Yearn Finance can be undervalued if you’re bullish on DeFi and Ethereum.

Every project has pros and cons just like this one. Yearn Finance had a very interesting launch due to the creator NOT keeping any coins.

This is a good thing. The project also serves a need, which is reducing gas prices for Ethereum with liquidity mining.

Liquidity mining is “great” because you can earn money from your money (who doesn’t like that?). There is also a very low supply and there is a demand for the product.

Low supply and high demand mean the price probably will go up, but anything can happen.

What I don’t like about Yearn Finance is it’s completely dependant on Ethereum. Ethereum is going through a lot of changes now and is turing complete.

Turing complete means it can do “everything” but there is more of a chance of something going wrong. If there is a bug in the smart contract then “anything” can happen.

In fact, in February there was a mistake in which 11 million dollars was drained and you can read about it HERE. Oops, the reason there is Ethereum Classic and normal Ethereum is due to a mistake in the code.

A second thing is the UI (User Interface) looks old-fashioned and is NOT very user-friendly (this is just my opinion).

People are lazy, so the easiest it is for someone to use the product, the better! It’s also difficult to find tutorials on how to use the system.

When it comes to liquidity mining there is a risk of “impermanent loss.” This is when the value of 1 coin goes down and you withdraw your deposit.

The truth is this impermanent loss can happen if you just hold any token (or investment) so it’s the same risk with anything.

Conclusion

I’m bullish on YFI because I feel DeFi and smart contracts will grow, but anything can happen. My favorite DeFi project is based on Bitcoin because it’s more stable and simple.

Oh, and there are NO gas fees!

They are also doing some cool stuff with tokenizing stocks and assets. They have a massive German community and I know the founders. You can learn more about this DeFi project by clicking on this link HERE.

Sadly, many governments are printing money at alarming rates leading to inflation. Crypto is one tool we can all use to keep ahead of it.

Whatever crypto project you’re into it’s a good idea to have your money work for you.

I hope this post on Yearn Finance was helpful to you. Bye for now.